Blockchain in Banking: Key Benefits, Trends, and Future Insights

Technology is king in the twenty-first century. People are prepared to adopt new technology because there is a growing need for modernization. One of those cutting-edge technologies with a significant impact on the market and industry is blockchain. From the viewpoint of regular people, a blockchain is a data structure that safeguards security, transparency, and decentralization while storing transaction records. Every transaction on the Blockchain is protected by a digital signature, which attests to its reliability. Blockchain uses encryption and digital signatures to store data that cannot be altered or changed. .

On a blockchain, there are two requirements to modify a record: one is to change a few records, and the other is to change the entire record. That is why it is exceedingly challenging to modify information that has been successfully entered into a Blockchain. Innovations like the Blockchain will make transactions fundamentally, sufficiently, and even more securely possible. This invention is incredibly inspiring. It is presently present in numerous locations. Additionally, it can handle any financial situation.

This invention gained notoriety after the introduction of the first cryptocurrency, known as bitcoin. The development of Blockchain applications can solve the significant banking problems that exist at the time.

This blog article will demonstrate how to operate on a reliable blockchain-based system without the need for delegated materials.

Trends of Digital Banking in 2022

Deloitte thinks that most international banks are still far behind despite increased investments in technology. For the foreseeable future, it is anticipated that this trend in digital banking will continue. For instance, by 2022, American banks are likely to spend 50% of their IT budget on new technologies, while banks in Europe will spend 30%. These figures are significantly higher than the threshold level of 27%.

Even before the Covid-19 outbreak, online banking was a crucial component of the retail banking infrastructure. The banking industry is using technology more and more as a result of the crisis. The investment necessary (cost of bank development or other technology applications) is undoubtedly a crucial consideration for banks. However, given the rising customer demand for internet banking, this is unavoidable.

One in five persons utilized internet banking for the first time during the outbreak, according to a recent Deloitte poll. Only 6% of those surveyed say they've never used online banking software. For the first time, the majority of consumers acknowledged that they will use at least one digital banking service in the years following COVID-19.

Benefit Blockchain-Based Banking App gives to Customers:

A blockchain-based banking app for smartphones has the benefit of being accessible 24/7. To top off your personal account balance or make payment for public services, you don't need to choose a day, drive to the bank, and stand in line. There are no temporary access limitations to the bank's customer accounts, barring any coding errors by the developers. You must complete the process in order to proceed. This limit can be established unilaterally by the consumer thanks to a decent application, which improves the banks' reputation and boosts public confidence.

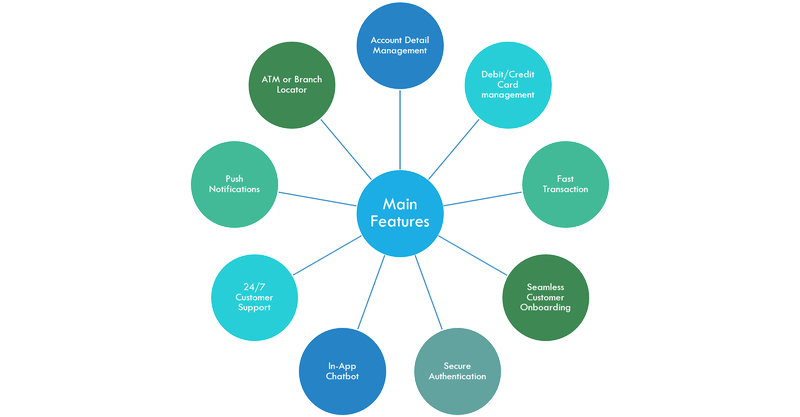

Must add Features of Blockchain-Based Banking App

- Management of Account Details:

To update their phone number or house address in their bank account, a customer may occasionally need to either access the web portal or merely visit their local branch. Customer access to managing personal account information should be simple and easy to access. This makes this functionality crucial for customers.

- Management of Debit/ Credit Cards

The same mobile banking software must allow customers to apply for new ATMs, debit/credit cards, or both. Consider a scenario where a customer loses their card and can still make a payment online. In these circumstances, the consumer needs to be able to quickly block the card using their smartphone's mobile app.

- Fast Speed Transactions

Modern consumers desire speedy payments through their mobile banking app.

Developers must interface their banking application with their bank server in order to provide mobile payments. Only transaction data are shown to make it apparent that the mobile application is not processing payment information.

To make transactions easier, you can also let customers pay using the recipient's phone number and other methods. Don't forget to consider whether you will be paid a transaction fee by the customer.

- Seamless Customer Onboarding

New customers frequently believe that it will be challenging to establish their relationship with another bank. Making a ledger is difficult, starting with the application structure accommodations and continuing with the KYC. If your banking application gives users the ability to complete KYC and ledger transactions quickly, you'll see an increase in the total number of customers as a result of increased client retention.

- Authentication that is secure

Due to KYC and AML regulations, client validation is crucial for advanced banking. To verify client access, blockchain apps typically use secret keys, PINs, unique mark sensors, or retina scanners. It is possible to test frequently for keeping the application secure without impairing the user experience. In this way, assigning or rethinking your mobile banking application development work to a specific development team with expertise in blockchain application development is always advised.

- In-App Chatbot

Chatbots can enhance banking in a number of ways. The primary goal is to give customers access to banking in a 24-hour manner. A properly designed chatbot can assist people to stay up to date on the details of their records, verify whether x amount was deducted from their records, and so on. While these are the essential features that define how to build a financial mobile application, there are a number of advanced features that can increase project revenues when developing mobile banking applications. QR filters, Customary payments, 3rd party integration, etc. are a few examples.

- 24 hours Customer Support

Most users of mobile banking experience a steep learning curve and frequently need assistance right away. Customer service outsourcing or recruiting is not always significantly affordable. Therefore, the ideal method for many businesses to increase access to their services is by developing a customer care chatbot.

You must determine where your users need assistance in order to create chatbots, which require a unique development procedure. The developers will build a financial chatbot using machine learning and artificial intelligence methods based on the findings. Chatbots offer 24/7 customer support and help you save time and money.

Numerous other options exist for banking software to assist you in enhancing customer service. For instance, a consumer can just click on the "Help symbol" to call or chat with customer service.

- Push Notifications

Every mobile application, including banking applications, must include message pop-ups. Typically, there are three types of message pop-ups:

- Conditional notices inform clients of record updates.

- Application-based notifications sound when a client's attention is required by the mobile banking application due to demands for secret word changes or report entries.

- Clients are to be given limited-time warnings to demand restrictions and arrangements.

The most important conditional warnings are those used in mobile banking application development. The client will be alerted by these alerts regarding moving assets that are active or about to transfer, premium income, development expenditures, accreditation approvals, and confirmations.

- ATM or Branch Locator

A simple but important part of a mobile banking application is finding the bank branch and ATM. To comprehend this component, the developers can integrate Apple or Google maps into your app.

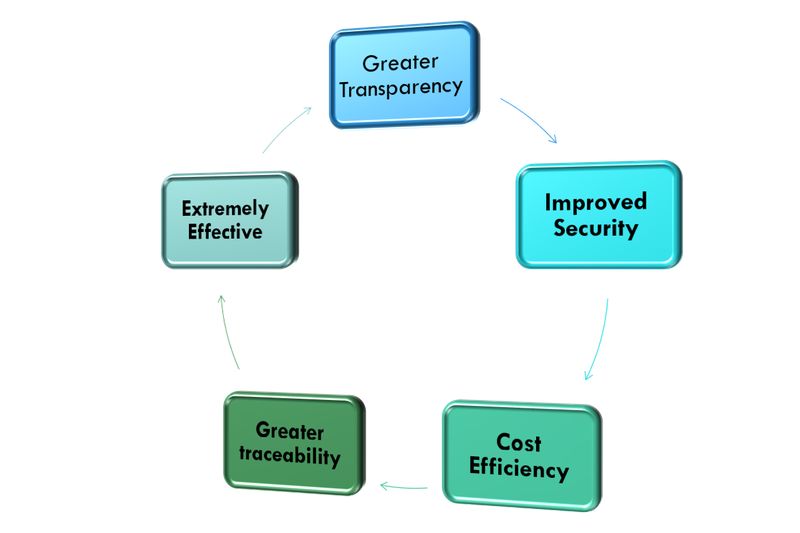

Various Benefits Blockchain-Based Banking App Offers:

You must comprehend the benefits of Blockchain technology if you work in the sector. You are aware of upcoming developments if your business purchases a blockchain or has plans to use one in the future. These advantages are frequently directly connected to the fundamental capabilities of the blockchain. Let's assess its value.

- Greater Clarity/Transparency

One of the most crucial challenges in today's market is transparency. Companies have tried to impose more rules and regulations in an effort to increase transparency. But the focus is one thing that no system ever completely makes apparent.

Blockchain enables businesses to participate in completely decentralized networks without a central point of reference, increasing system transparency.

Copies of a blockchain serve as the counterparts that execute and validate transactions. Peers may opt to take part in the validation process even though not all of them participate in the consensus approach. Through decentralization, the consensus technique is employed for validation. Each node keeps a copy of the transaction history after validation. Blockchain approaches transparency in this way.

For businesses, transparency has more significant consequences. Governments can employ openness to set up or even coordinate government processes, as was previously indicated.

- Improved Security

Compared to traditional operating systems or data monitoring systems, blockchain technology employs improved security. According to the consensus procedure, each transaction that needs to be registered must be approved. Due to the hash mechanism, each transaction is also encrypted and has a solid relationship to the prior transaction.

The fact that every node has a copy of the network transactions in progress further improves security. As a result, other nodes will reject your request to write transactions on the network, preventing any malevolent players from changing the transaction. Blockchain networks are also immutable, meaning that once data has been written, it cannot be changed back. Additionally, it is the best option for systems that expand with immutable data, such as those that age citizens.

- Cost Efficiency

Businesses are currently investing a lot of money to manage their current system better. They want to reduce expenses and move money so they can create new things or enhance existing firms.

Businesses may cut many of the costs related to third-party providers by utilizing the Blockchain. No fees are paid to the seller because there is no inherited central player on the Blockchain. Additionally, there is no requirement for interaction or the expenditure of time or money on routine chores when certifying a trade.

- Greater traceability

Businesses may concentrate on building a supply chain that works with suppliers and suppliers thanks to the Blockchain. In a typical supply chain, it is challenging to trace commodities, which can result in numerous issues like theft, fraud, and product loss.

The supply chain is more transparent than ever thanks to blockchain. Each party can trace the products in this way, ensuring that they are not traded or utilized improperly throughout the supply chain. Businesses can potentially improve blockchain tracking by implementing it inside.

- Extremely Effective

Improved efficiency and speed are the most recent industrial advantages provided by Blockchain wallet application development. The time-consuming process is resolved by blockchain technology, which automates it for optimal effectiveness. Automation also gets rid of human errors.

All of this is made possible by Digital General Bureau, which offers a location to keep transactions. Process simplification and automation also result in increased productivity and speed.

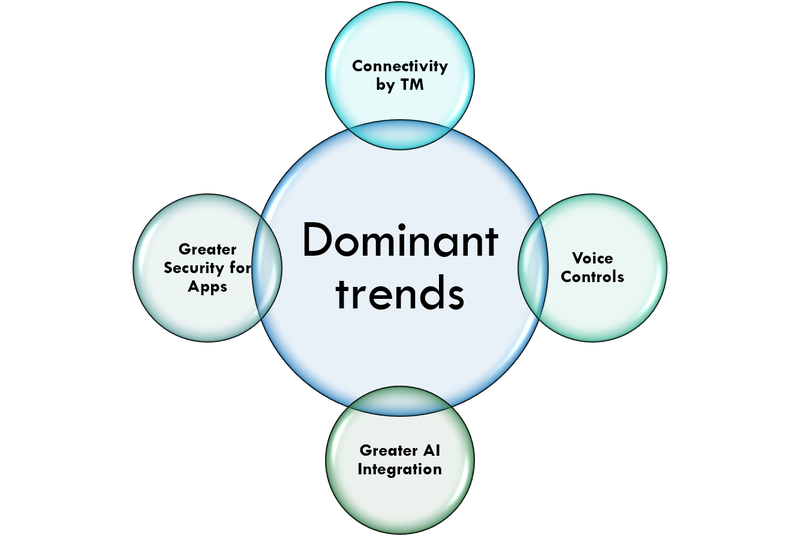

Dominant Trends of Blockchain-Based Banking Apps

- Connectivity by TM

Customers may handle their ATM transactions without looking for their ATM cards and without inputting a password in a public setting thanks to advances in QR code scanning and NFC technology.

- Voice Controls

You'll discover that the banking sector broadly accepts the same language technology. Users may now use voice commands to check their account balance or to easily transfer money to contacts.

- Greater AI Integration

Several attempts to apply artificial intelligence in banking and payment processes have been launched this year. Artificial intelligence and machine learning are heavily incorporated by banking institutions across a range of functions, including fraud detection and 24/7 user-bank communication.

- Greater Security for Apps

Even if the banking industry is one of the safest, 2021 will allow for hacking. When selecting your device, keep the following in mind.

Multi-factor authentication systems, end-to-end encryption, fingerprint authentication, real-time notifications, and the incorporation of artificial intelligence (AI) to detect fraud, among other things.

Final Thoughts

It wouldn't be inaccurate to claim that blockchain technology has changed the game. Each bank has specific demands that blockchain software must abide by. Customer pleasure, nevertheless, unites all of these financial companies. The most practical method for doing this is application development.

The needs are something that developers prefer to consider when providing dependable and portable mobile applications.

In essence, Decodermind constructs the software with customer pleasure and security as our primary concerns, managing the cost of developing banking blockchain applications. These functions may just show a bank account for money transfers, credit card information, or other functions of a like nature.

Hamid Salman

Hamid Salman