Demystifying App Development: Build Financial and Banking Calculator App.

In the modern digital age, financial literacy and convenience are more important than ever. Mobile banking and financial apps are gaining popularity, offering users a wealth of tools to manage cash, make informed decisions, and achieve their financial goals. One unique form of application, the financial and banking calculator, occupies a valuable position in this atmosphere or ecosystem by providing users with quick and easy-to-use calculations for different financial scenarios.

Whether you're a seasoned developer or an entrepreneur bursting with an incredible app concept, understanding the intricacies of building financial and banking calculator apps is critical to success.

This blog post equips you with the know-how and insights you need to navigate the app development process, overcome common challenges, and launch a thriving application that empowers app users to manipulate their budgets.

Understanding the Need for Financial and Banking Calculators Apps:

The upward momentum of mobile banking and money apps is undeniable. According to Statista, the global mobile banking base is projected to reach 2.7 billion by 2025, representing a large portion of the world's population. This increase in adoption is fueled by a growing desire to:

- Financial Literacy: people are increasingly looking for ways to achieve a higher price range, make informed choices, and reap financial aspirations. Financial Calculator’s applications offer effectively accessible tools for budgeting, making investments, planning loans, and various calculations that provide users the appropriate or demanded financial knowledge.

- Convenience: In the high-end and fast-paced international world, convenience reigns supreme. Such mobile applications provide instant access to financial tools and calculations, delaying the need for rough calculations or bulky spreadsheets. This convenience factor is the main driving force behind app adoption.

Impact of financial and banking calculator applications:

- Improved financial decisions: By providing users with easy-to-use calculators for different financial scenarios, these apps can help them make informed decisions about budgeting, saving, investing, and borrowing. This can result in higher financial results in the long run.

- Increased Financial Literacy: By making financial calculations easy to hand and easy to understand, these apps can help increase users' financial literacy. This in turn can cause better confidence in managing private finances and develop a more informed approach to achieving monetary goals.

- Better user engagement: When designed effectively, financial and banking calculator applications can offer an attractive and interactive experience to their users. This can increase loyalty and inspire repeat use of the application, contributing to the app's success in the long run.

Examples of Popular Financial and Banking Calculators Apps:

- Mint: A budgeting and expense tracking app offering various calculators, including loan affordability, mortgage, and retirement planning.

- Personal Capital: A wealth management app featuring calculators for retirement planning, investment returns, and net worth tracking.

- NerdWallet: A personal finance platform offering numerous calculators, covering loan comparisons, mortgage rates, and credit score estimation.

- Tricentis Flood: A mobile app testing platform used by financial institutions and developers to ensure the security and functionality of financial apps.

Key Takeaways:

- Financial and banking calculator apps address a growing need for financial literacy and convenience in the digital age.

- These apps empower users to make informed financial decisions, improve financial literacy, and engage in their financial well-being.

- Understanding the types of calculator apps, their functionalities, and the target audience is crucial for successful development.

Also, read | Blockchain in the Banking Sector: Key Features, Benefits, and Trends

Planning Your App Development: Features and Functionality

Building a successful financial and banking calculator app hinges on carefully defining its features and ensuring they align with your target audience's needs. Here's a roadmap to guide you through this crucial stage:

Identifying Essential Features Based on App Type:

The specific features your app offers will depend on the type of calculator you're developing. Here are some common categories and their core functionalities, expanded with additional options:

Loan Calculators:

- Mortgage Calculator: Calculate monthly payments, total interest paid, loan comparison options, amortization schedule, and impact of different down payment amounts.

- Auto Loan Calculator: Estimate monthly payments, total interest, loan comparison based on different terms and interest rates, lease vs. buy comparison, and impact of trade-in value.

- Personal Loan Calculator: Calculate monthly payments, and total interest, compare loan options based on different APRs and repayment terms, factor in origination fees, and estimate debt consolidation savings.

- Student Loan Calculator: Calculate monthly payments based on different repayment plans, estimate total repayment amount and interest paid, and explore refinancing options.

Investment Calculators:

- Compound Interest Calculator: Analyze the impact of compounding on investment growth, compare different investment scenarios, and explore the power of time and consistent contributions.

- Investment Return Calculator: Calculate potential returns based on investment amount, interest rate, time horizon, and factor in various investment types (stocks, bonds, mutual funds).

- Retirement Planning Calculator: Estimate future retirement savings needs based on current income, contributions, expected retirement age, and desired lifestyle.

- Savings Goal Calculator: Determine how much you need to save regularly to reach specific financial goals (e.g., down payment, dream vacation) based on the time frame and desired amount.

- Portfolio Analyzer: Analyze the performance and diversification of your investment portfolio, identify potential risks, and suggest asset allocation strategies.

Budgeting Calculators:

- Income and Expense Tracker: Monitor income and expenses categorized by income source (salary, side hustle), spending categories (rent, groceries, entertainment), and track bills due.

- Monthly Budget Planner: Allocate income towards different categories (rent, groceries, entertainment, etc.), set spending limits, and track progress toward financial goals.

- Debt Payoff Calculator: Estimate the time and amount needed to pay off debt based on different strategies (avalanche vs. snowball methods), factor in extra payments, and track progress toward debt freedom.

- Bill Reminder: Set reminders for upcoming bills, automate payments, and avoid late fees.

- Subscription Tracker: Monitor recurring subscriptions, identify areas to cut back, and manage spending on subscriptions.

Additional Calculator Categories:

- Currency Converter: Convert between different currencies with real-time exchange rates, compare historical rates, and set alerts for favorable exchange rates.

- Tax Calculator: Estimate federal, state, and local income taxes based on income, deductions, and filing status.

- Tip Calculator: Split bills easily, calculate appropriate tips based on service and custom percentage, and factor in group size.

- Credit Score Calculator: Estimate credit score based on factors like payment history, credit utilization, and credit age, and provide tips for credit score improvement.

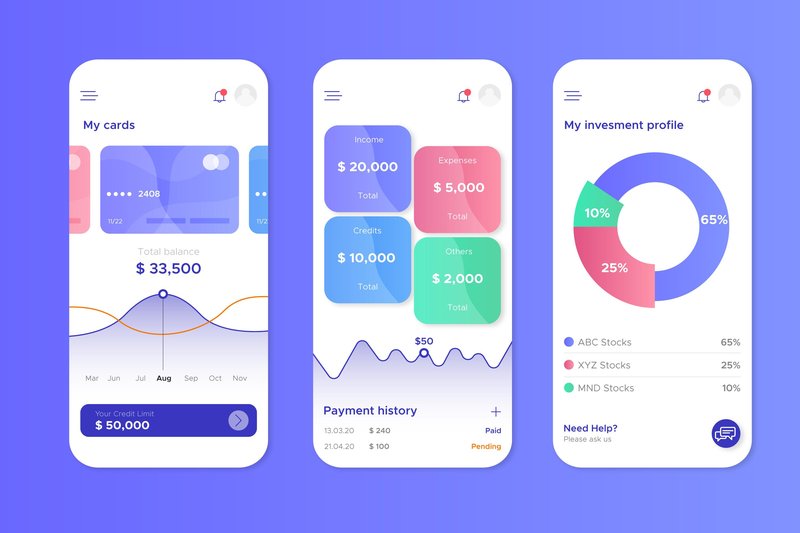

Prioritizing User Experience and Design:

Remember, even the most comprehensive financial calculator application won't succeed if it's clunky and difficult to use. Prioritize user experience (UX) and layout with these ideas in mind:

- Intuitive Interface: Ensure the app is easy to navigate, with clear labels, a logical layout, and minimal steps to access desired calculations.

- Interactive Elements: Incorporate interactive features like sliders, graphs, and visualizations to enhance user engagement and understanding.

- Accessibility: Make the app accessible to users with disabilities by adhering to WCAG guidelines and implementing features like screen reader compatibility.

Additional Features to Consider:

While the core features are essential, keep in mind these additional features that will spice up your app's proposition:

- User Accounts: Allow users to create accounts to store preferences, track progress, and access personalized calculations.

- Data Synchronization: Enable users to sync data across devices for seamless access and convenience.

- Integration with Financial APIs: Integrate with financial data APIs to allow users to import real-time data for calculations.

- Educational Resources: Include educational content within the app to improve financial literacy and user engagement.

Case Study: Mint App's Calculator Features:

The popular budgeting app Mint offers a variety of calculators alongside its core expense-tracking functionality. These calculators address various financial needs, including:

- Loan affordability calculator: Helps users estimate how much they can afford to borrow for a mortgage or other loan.

- Mortgage calculator: Allows users to compare different loan options and visualize the impact of different interest rates and terms.

- Retirement planning calculator: Estimates future retirement savings based on current contributions and future income needs.

- Investment return calculator: Analyzes potential returns on investments based on different factors.

Mint's success highlights the Value of providing multiple calculator features to meet different business or private financial needs. Based on information about your target audience and their pain points, you can prioritize features that resonate and add value to their financial journey.

Remember: Planning your application's capabilities or features is a repetitious process. Conduct solid and in-depth user research, gather feedback, and research competing services to refine your signature set and ensure it delivers a thoroughly valued, relishing consumer experience.

Also, read | Development of a SaaS-based E-Commerce Application

Choosing the Right Tools and Technologies: Building Your Financial and Banking Calculators App

Now that you've outlined the features and functionality of your financial calculator app, it's time to dive into the technical side of the development. Choosing the right tech stack will greatly affect your app development process, the overall performance of the application, and ultimately the user experience. Here's a roadmap to help you choose a technology suite:

Selecting the Right Development Platform:

The first crucial decision is choosing the platform where your app will reside. Popular options include:

- Android: Ideal for reaching a vast user base with diverse devices. Requires Java or Kotlin programming languages.

- iOS: Strong for premium app experiences and a loyal user base. Uses Swift programming language.

- Cross-platform development: Frameworks like React Native and Flutter allow you to build apps for both Android and iOS with a single codebase, saving time and resources.

Factors to consider:

- Target audience: Who are you building the app for? Where do they primarily use their mobile devices?

- Budget and development expertise: Do you have experience with specific languages or frameworks? Weigh the cost-benefit of each option.

- Performance and scalability: How complex are your app's features? Do you anticipate high user volume?

Essential Tools and APIs for Financial App Development:

Several tools and technologies can streamline your development process and enhance your app's capabilities:

Programming Languages:

- Java(Android)

- Kotlin (Android)

- Swift (iOS)

- JavaScript (React Native)

- Dart (Flutter)

Integrated Development Environments (IDEs):

- Android Studio (Android)

- Xcode (iOS)

- Visual Studio Code (cross-platform)

Financial Data APIs:

- Intuit Mint (provides access to user's financial data with their consent)

- Plaid (connects users to their bank accounts securely)

- Yodlee (financial data aggregation platform)

Payment Processing APIs:

Security and Authentication Tools:

- Firebase Authentication

- Auth0

- Amazon Cognito

Additional Tools and Technologies to Consider:

- Cloud Platforms: Leverage cloud services like Amazon Web Services (AWS) or Microsoft Azure for storage, scalability, and backend infrastructure.

- Analytics Tools: Integrate analytics tools like Google Analytics or Firebase Analytics to track user behavior and measure app performance.

- Testing Tools: Utilize testing frameworks like JUnit (Android) or XCTest (iOS) to ensure app functionality and quality.

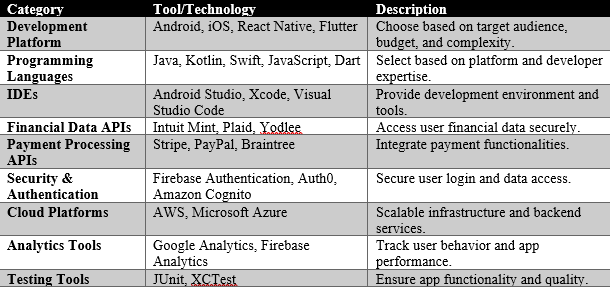

Table of Tools and Technologies:

Remember: This table provides a starting point, and research specific tools based on your app's unique needs and chosen platform.

Also, read | Top 6 Most Used Mobile App Development Frameworks

Overcoming Common Challenges in Finance App Development:

Navigating the financial app development landscape involves unique challenges that require careful consideration and proactive solutions. Here are some key hurdles you might encounter and strategies to overcome them:

Security and Data Privacy:

- Financial data sensitivity: Users entrusting your app with their financial information demands robust security measures. Implement industry-standard encryption, secure authentication protocols, and regular security audits.

- Regulatory compliance: Adhere to relevant data privacy regulations like GDPR and CCPA, ensuring user consent for data collection and usage transparency.

User Authentication and Authorization:

- Secure login and access: Implement multi-factor authentication and strong password requirements to prevent unauthorized access.

- User roles and permissions: Define different user roles (e.g., basic user, premium user) and assign appropriate access levels to data and functionalities based on trust and authorization.

Data Accuracy and Reliability:

- Data sources and integration: Ensure the accuracy and reliability of financial data sources you integrate, whether internal APIs or external services.

- Testing and validation: Implement thorough testing procedures to validate calculations, data handling, and overall app functionality.

User Experience and Engagement:

- Intuitive and user-friendly interface: Design a clear, navigable interface that caters to diverse user needs and technical skill levels.

- Accessibility: Ensure the app is accessible to users with disabilities, adhering to WCAG guidelines and implementing features like screen reader compatibility.

Legal and Regulatory Compliance:

- Financial regulations: Understand and comply with relevant financial regulations specific to your target market and app functionalities. Seek legal counsel for guidance.

- Consumer protection laws: Adhere to consumer protection laws regarding data privacy, fair lending practices, and transparent disclosures.

Additional Tips:

- Conduct thorough user research: Understand your target audience's pain points, expectations, and technical proficiency to inform your app design and features.

- Prioritize security from the outset: Build security into every stage of development, not as an afterthought.

- Seek expert advice: Consult with financial and legal professionals to ensure compliance and address regulatory complexities.

- Stay updated: Remain informed about evolving regulations and technological advancements in the financial app landscape.

By proactively addressing these challenges and adopting satisfactory practices, you can create a stable, human-friendly, and responsive financial and banking calculator application that empowers users and thrives in a competitive market.

Also, read | How to Develop a Crowdfunding App

Launching Your App and Achieving Success:

Now comes the crucial step: launching your app and ensuring its success in the competitive app market. Here's your roadmap to a triumphant launch:

App Store Optimization (ASO):

- Optimize your app title, description, and keywords: Research relevant keywords users search for and strategically incorporate them into your app store listing to improve discoverability.

- Create compelling screenshots and previews: Showcase your app's features and user interface with high-quality screenshots and engaging video previews.

- Monitor and refine your ASO strategy: Track app store performance metrics and iterate on your keywords and listing based on user behavior and search trends.

Marketing and User Acquisition:

- Organic marketing: Leverage social media platforms, content marketing (blog posts, articles), and influencer marketing to generate organic interest and downloads.

- Paid advertising: Consider targeted advertising campaigns on social media platforms, app store search results, and relevant websites to reach potential users.

- Public relations and partnerships: Partner with financial institutions, bloggers, or media outlets for app promotion and reviews.

User Engagement and Retention:

- Onboarding experience: Create a smooth and informative onboarding process to guide users through app features and encourage initial engagement.

- Push notifications: Utilize push notifications strategically to inform users about new features, relevant calculations, and personalized financial insights.

- Community building: Foster a community around your app through social media engagement, in-app forums, or user feedback channels.

- Continual updates and improvements: Regularly update your app with new features, bug fixes, and performance enhancements to keep users engaged and demonstrate your commitment to improvement.

Key Performance Indicators (KPIs) and Analytics:

- Track key metrics: Monitor downloads, active users, engagement time, user reviews, and feature usage to understand user behavior and app performance.

- Analyze and adapt: Use data insights to make informed decisions about app updates, marketing strategies, and future feature development.

Building Trust and Legitimacy:

- Transparency and privacy: Clearly communicate your data collection practices, privacy policies, and security measures to build user trust.

- User feedback and reviews: Actively respond to user feedback and address negative reviews promptly and professionally.

- Partnerships and certifications: Partner with recognized financial institutions or seek industry certifications to establish credibility and trustworthiness.

Remember: Launching the app is just the beginning. Continually improve your app primarily based on app user feedback, stay ahead of industry trends, and adapt to new and effective marketing techniques or strategies to ensure long-term success. With these techniques and a demonstrated dedication to user experience and proposition, your financial and banking calculator app can empower users and carve out an area of interest in the ever-evolving mobile phone landscape.

Also, read | Expense Tracking Mobile App

Conclusion: Empowering Users, Building Success in the Financial App Landscape

The mounting demand for financial literacy and convenience paved the way for valuable amenities such as financial and banking calculator apps. By creating a consumer-friendly, secure, and feature-rich app, you can empower users to make informed financial choices or decisions, achieve their time-based goals, and navigate the complexities of personal finance with confidence.

Summary Points:

- Financial and banking calculator apps address a crucial need in today's digital age, offering readily available tools for budgeting, investing, loan planning, and more.

- Careful planning, selecting the right tools and technologies, and prioritizing user experience are essential for successful development.

- Overcoming challenges like security, data privacy, and regulatory compliance requires proactive strategies and adherence to best practices.

- Launching your app effectively involves app store optimization, strategic marketing, user engagement strategies, and ongoing analysis of performance metrics.

DECODERMIND YOUR TECH PARTNER:

Ready to turn your vision of a financial app into reality?

Contact Decodermind, the Best Custom Software Development Company in Town!

Why choose Decodermind?

- Experienced team: Our team of skilled developers possesses extensive experience in building secure, user-friendly, and high-performing financial apps.

- Proven track record: We have a proven track record of delivering successful software solutions for businesses of all sizes, across diverse industries.

- Agile methodology: We employ an agile development methodology, ensuring flexibility, adaptability, and close collaboration with you throughout the process.

- Cost-effective solutions: We offer competitive rates and transparent pricing, ensuring you get the best value for your investment.

Don't wait! Start your journey towards building a successful financial and banking calculator app today. Contact Decodermind and let us transform your vision into reality.

Hamid Salman

Hamid Salman